S&P 500 Forecast for Monday, September 21, 2020

- Kapproveb Alcyone

- Sep 16, 2020

- 2 min read

Updated: Aug 1, 2022

***********

% ( correct statements out of statements.)

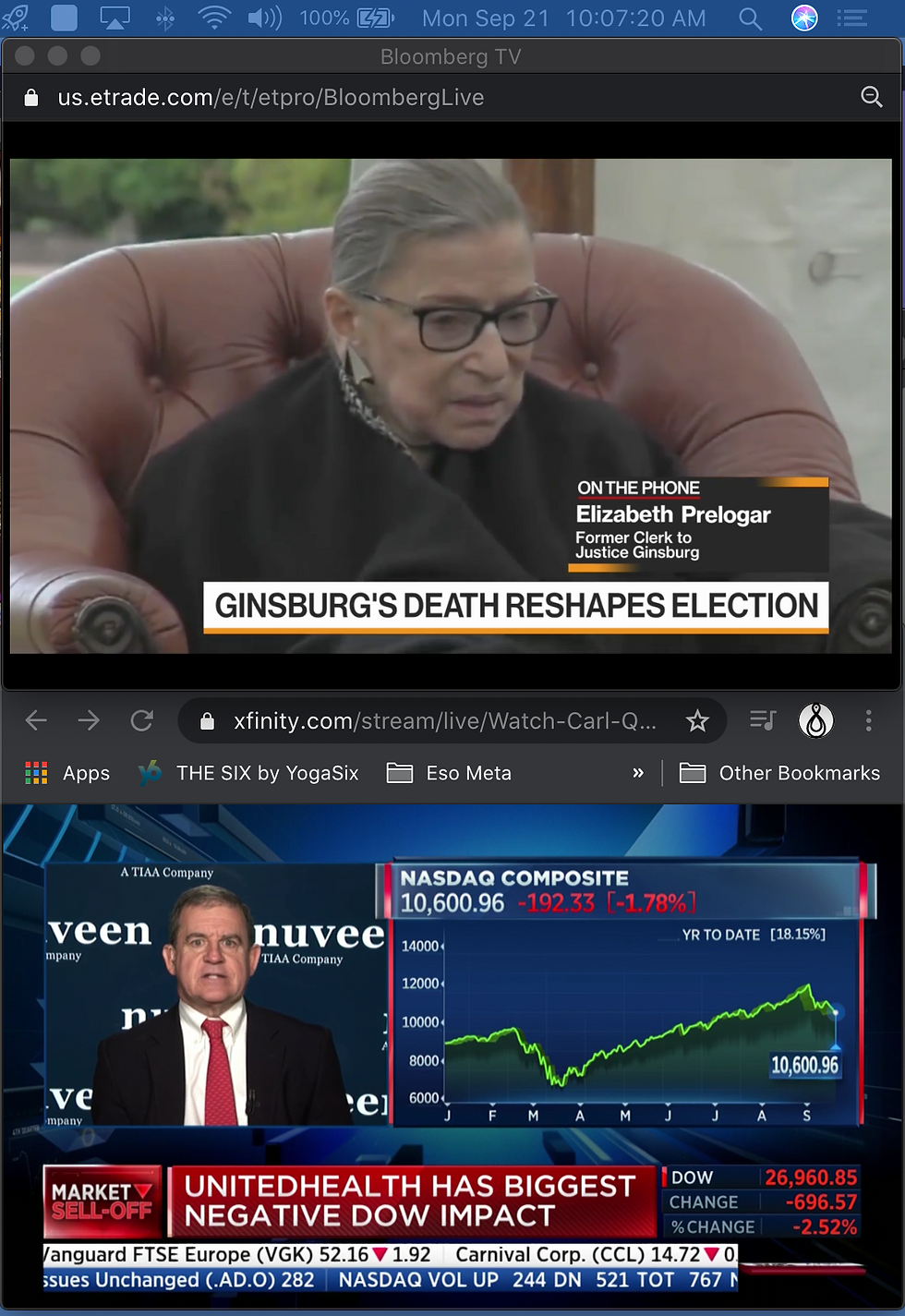

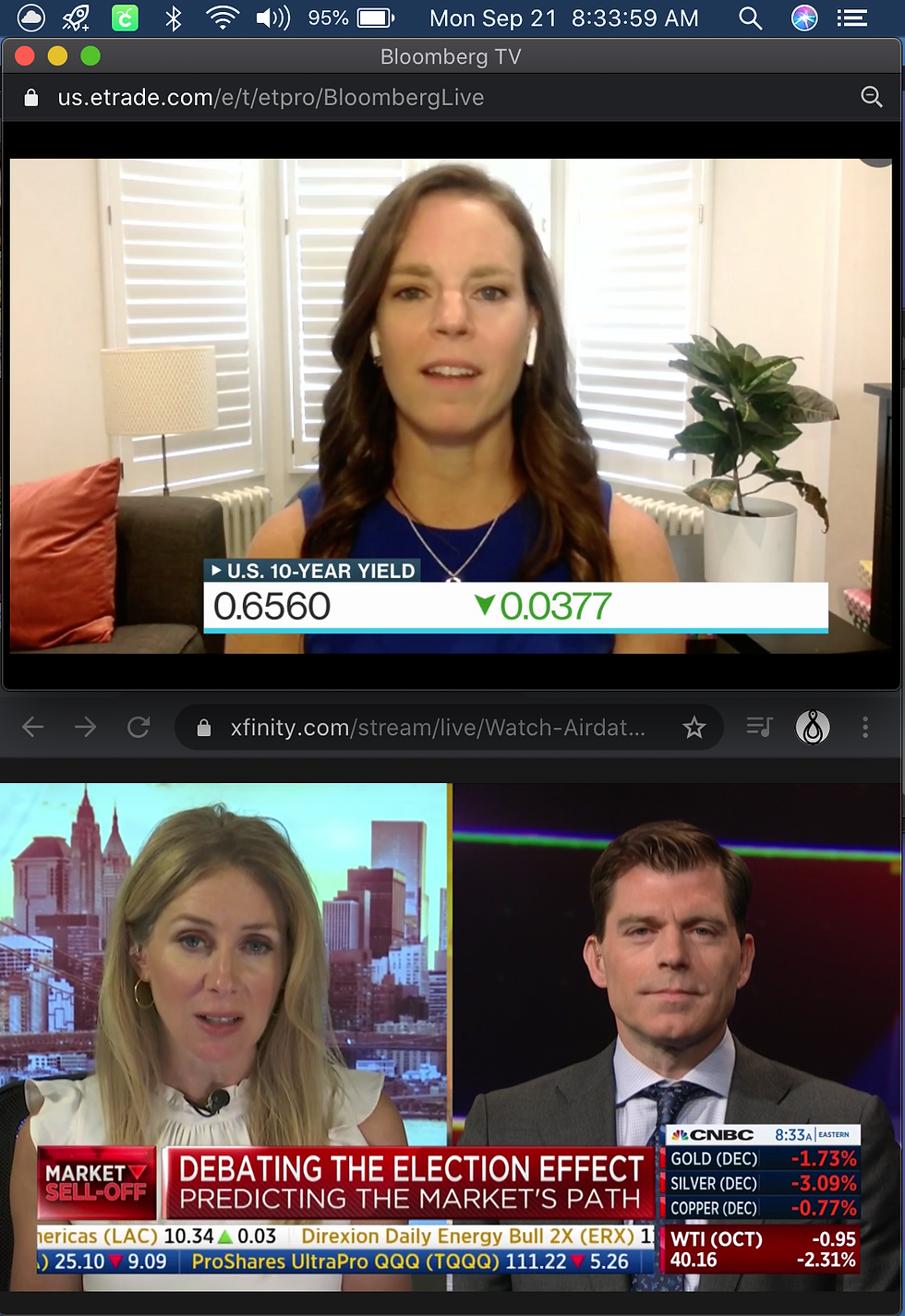

Day's Theme - Establishment of or returning to a notable support/resistance. Retesting a notable support level as many as 3 or 4 times. A move higher AND/OR a gap up in the premarket. At or near the market open there will be an opportunity pertaining to the legislative AND/OR judiciary branches of government. A decline through a support level AND/OR an move higher followed by a decline through a support level. Between roughly 10:30am and 12:30pm est there will be a misleading indication of the markets direction in the form of a notable move higher AND/OR notable technical indicator. The day's high will be involved with AND/OR the day's high will form somewhere around the misleading indication. Around midday the S&P meets resistance at the upper end of a notable range AND/OR bounces sideways between a tight range. Between roughly 1pm and 2pm is a decline to meet support at the lower end of the range AND/OR there is more bouncing sideways around support at the lower end of the range. Around the last 2.5 hours of trading there will be a noticeable "U" shaped dip down through support/resistance to a/the low. The dip is followed by a retracement back up to AND/OR through the same support/resistance. A rally into the close. Closes lower. In the postmarket a notable decline AND/OR sharp decline takes place.

1-Day High - Between roughly 10:30am and 12:30pm est there will be a misleading indication of the markets direction in the form of a notable move higher AND/OR notable technical indicator. a day's high will form between roughly 10:30am and 12pm est. AND/OR in the post market.

1-Day Low - a low forms between roughly 2pm est and the postmarket.

Planned Trades - I will most likely close my same day expiration options contracts first thing around the close and wait until tomorrow. I am advised to wait until tomorrow to open any new trades. There will be better opportunity tomorrow. The fulfilment of classic technical analysis AND/OR a scientific breakthrough is highlighted around tomorrow's opportunity.

#AstroOpportunityWindow Begins20/9/20@4:42pm est. Finishes21/9/20@11:13am est.

#MoonInScorpio #1stQuarterMoon #1stQuarterMoonInScorpio #MoonInSagittarius #1stQuarterMoonInSagittarius

#MercuryLibraSquarePlutoCapricorn @1:21am est.

#MoonScorpioSextilePlutoCapricorn @3:07am est.

#MoonScorpioSextileSaturnCapricorn @7:50am est.

#MoonScorpioQuincunxMarsAries @10:45am est.

#MoonScorpioSextileSunVirgo @2:13pm est.

#MoonEntersSagittarius @3:32pm est.

#VenusLeoQuincunxJupiterCapricorn @9:12pm est.

#Tarot #traders #FinancialMarkets #SPX #StandardAndPoors #Stockmarket #EsotericAnalysis #StockMarketPrediction #StockMarketForecast #2020Forecast #Precognition #S&P500

#2020stockmarket #BeatTheMarket #DayTradingGuidance #TarotAndStockMarket #DayTrading #PatternTrading #SwingTrading #StockMarketPsychic #S&P #Historical one day chart of S&P 500 #Historical stock market news head lines #Free customizable technical stock charts

Comments