Search Results

2289 results found with an empty search

- 2023 One Year Silver Predictions

Year’s theme : Very bearish overall, however there may be a significant move to the upside near mid-year. Behavior around the high: A U-shaped dip forming between the intersection of two perpendicular diagonal trend lines. Behavior around the low: A notable decline to reach the low. Out of the low, there’s a movement from the bottom of a range to the top of a range. Trade opportunities : A trade opportunity at a support level that we’ll rotate sideways along in March. A swing trade opportunity at the high in April. A swing trade opportunity around the month’s low in mid-August. A swing trade opportunity when we’re rotating along key support in late August. A swing trade opportunity when rotating sideways along key support in early September. Swing trade opportunities around both the low and high for November. A significant trade opportunity around a brief peak in late December. Overview January: In January, we have a critical price level highlighted. Volume and volatility start to flatten out around this price level. There may be some sort of decision or agreement, likely around the high. There’s a price level around the high that offers an opportunity to position oneself in both directions and set up a straddle/strangle on a one-year chart. We’ll have an unexpected move higher out of the low. At the end of the month, it looks like we’re moving into a decline and breaking down through a support level that was recently broken down through, likely in the last quarter of 2022. February: It looks like we’ll see a rally in the first week or early in the second week of February. This rally offers a good opportunity to position oneself for a downturn. There’s a failed attempt to break through key resistance and a decline through key support on at least a one-month chart. There’s also a swing trade opportunity at this point involving a notable move to the upside reaching for distant resistance on a one-month chart. Around the low for February, we have a period of volatility that ends with a fast, sudden move higher. March: In early March, we’ll decline from a support level that we were rotating sideways along. There’s a trade opportunity at this support level. Around the high, there will be multiple headwinds pushing silver lower. There’s also a decline off of the high through multiple support levels on a one-year chart. We’ll have a move higher out of the low that will stand out and create a minor crest on a one-year chart. This will be a crest around the end of March and possibly into the beginning of April. There’s an important resistance level highlighted in late March. April: We rotate sideways along the resistance level that we saw at the end of March. It looks like the low for April may take place in the third week. There will be sideways rotation around the low and then we rise to meet the nearest critical resistance on a one-day chart. We’ll then fall back down and continue rotating along that support level. There’s a prominent trough that will stand out around mid-April. We’ll see the high toward the end of April. There’s a swing trade opportunity at the high. At the end of April, we have a move higher through resistance on at least a one-year chart. We’ll stay above that resistance level briefly and then break back down shortly thereafter with a full retracement. There’s a year’s high toward the end of April. May: In early May, there’s a prominent low that will stand out on a one-year chart. The low forms within a rally along a diagonal trend line that breaks down with increasing volatility on the way down. The low for May will be within close proximity to the highest high for the year. Out of the low, we have a notable move to the upside reaching for distant resistance on at least a one-month chart. The high for May will form when we have the halting of a bullish trend marked by a notable decline through a key support level on a one-year chart. There’s a rally that commences off of a period of sideways rotation toward the later part of May. In that period of sideways rotation, there’s a sharp dip. We revisit a support level that was recently a past opportunity. The rally into a year’s high is either in May or June. June: To reach the month’s high for June, we have a move out of oversold territory or to fill a previous gap down on the scale of a three-month chart. There’s a breakout to reach that high. Around the low, we’ll see erratic behavior back and forth through the same price level, and we’ll revisit a crest in the midst of that erratic behavior. Around the end of June, we’ll have a failed attempt to break through key resistance. Technicals will lead us to believe that we’ll break out through this resistance level. Instead, we fake out and decline through a key support level on a one-year chart. July: The low we see in April will likely be the same low in July. We have a prominent low for the year in July. There’s a move higher that will stand out on a one-year chart followed by a full retracement in late July. It looks like there’s a month’s high or crest toward the end of the month. A decline out of the high offers an opportunity to open up a long position. August: In early August, we’ll have multiple failed attempts to break through key resistance on a one-year chart followed by a decline through multiple support levels on a one-year chart. There’s a correlation to a rally along a diagonal trend line where we break through horizontal resistance, meet a secondary resistance, and then pull back to somewhere between those two price levels. It looks like we have a prominent trough or month’s low in mid-August. There’s a swing trade opportunity around the month’s low involving a cash-out opportunity when we’re rotating sideways along key support. It looks like that cash-out opportunity will be toward the end of the month. After a failed attempt to break through key resistance, we decline to meet a new key support level. There’s also a male ruler highlighted around the month’s high and a swing trade opportunity when we’re rotating sideways along key support. Around the month’s low, congress will be highlighted, and there’s a holding pattern with a notable move higher followed by a sharp decline back down. September: I’m advised to open up some protection around either late August or early September. There’s a prominent low for the year in early September. There may be some issue at this point related to climate change or some sort of natural disaster. There’s a swing trade opportunity here when we’re rotating sideways along key support. Around the month’s low, we’ll hit a critical resistance level. There’s a notable amount of volatility that increases after meeting that resistance level. We’ll see a failed attempt to break through resistance and then we’ll decline with increasing volatility as we move into the end of the month. There’s a notable move higher to reach the month’s high in September in the midst of seemingly overwhelming headwinds. October: In early October, we have a lot of price movement. I’m advised to open up some protection around a peak or crest in the midst of a big move higher in early October. We’ll then see some profit taking from that overbought peak or crest. There are some sideways bullish price swings around the high for October. I’m advised to follow my gut instinct in the second week. It looks like there will be a decline that commences at the upper end of a range on a one-month chart. Out of the low for the month, there’s a notable move higher. It seems like we’ll probably decline into the end of October. We’re bound by a notable range to both the upside and the downside around this time. November: There’s a trade opportunity in early November. The low will likely be mid-November. Out of the low, we’ll have the halting of a bullish trend marked by a sharp decline off of a peak or crest that will stand out on a one-year chart. There’s a swing trade opportunity around the low. When we meet the month’s high, we decline to and through a support level to meet another support level and then rotate sideways along that support for a bit. There’s also a swing trade opportunity around the high for November. We’ll then break down through multiple support levels on the scale of at least a one-month chart. December: We’ll have a higher high in December than we had in November. There’s a prominent crest in December that we’ll sell from. We’ll sell down to and through a support level on a one-year chart from that high or crest. This is followed by a U-shaped reversal back through that support level where we then reuse it as support. There’s a period of volatility in early December and a sharp drop in that period of volatility that will stand out on a one-year chart. The month’s low will form after a brief peak and a sharp drop off of that peak. That brief peak presents a significant trade opportunity. Sneak preview: For 2024, we have sideways rotation that ends with a notable move to the upside that reaches for distant resistance on at least a one-year chart if not a multi-year chart. #PrincessofSwords #5ofSwords #XTheFortune #9ofSwords #IITheUniverse #4ofWands #QueenofCups #XIITheHangedMan #VIIIAdjustment #4ofSwords #IXTheHermit #AceofWands #2ofDisks #5ofDisks #2ofSwords #PrincessofDisks #2ofCups #KnightofWands #QueenofDisks #3ofCups #5ofCups #XVIITheStar #KnightofSwords #XILust #ITheMagus #10ofSwords #3ofDisks #PrinceofDisks #PrincessofWands #6ofCups #KnightofDisks #AceofCups #IVTheEmperor #7ofSwords #QueenofWands #2ofWands #7ofCups #4ofCups #XIVArt #3ofSwords #8ofSwords #AceofDisks #IIITheEmpress #PrinceofSwords #10ofCups #10ofWands #XIXTheSun #9ofDisks #QueenofSwords #0TheFool #XIIIDeath #VTheHierophant #9ofCups #AceofSwords #9ofWands #8ofWands #6ofDisks #XVITheTower #8ofCups

- 2023 One Year S&P 500 Predictions

Year’s theme: Likely we’ll see the start of a rally. There are also several notable breakouts highlighted throughout the year. Behavior around the high: Bearish price swings and a sharp drop that will stand out on a one-year chart. Behavior around the low: A significant trade opportunity around the low. We’ll also have a move higher through a key resistance level and then break back down through that price level off of the low. Trade opportunities: In January there’s a significant trade opportunity around the month’s high. A swing trade opportunity around the low in April. A decline into the month’s low in May offers a significant opportunity to open up a long position. A swing trade opportunity around the high in June. A swing trade opportunity around the low in July involving a period of sideways fluctuations with a bullish trend that precedes a decline. An opportunity to open up a short position in the midst of a rally in July. Another swing trade opportunity in July that involves a period of volatility and a sharp dip that will stand out on a one-month chart. There’s a swing trade opportunity around the month’s high in October that involves a period of volatility with a sharp dip that will stand out on at least a one-month chart. Overview January: In early January, it looks like we decline out of a crest after the completion of a rally. There’s a trade opportunity around the month’s high. The low for the month is likely in the second week, at the very end of the month, or there are lows at both points. We decline from a support level down to a second support level, we’ll bounce along that support level for a bit, and then we’ll break down through multiple support levels on the scale of at least a one-month chart. It looks like there’s the beginning of a rally around that low. It’s a prominent low that will stand out on a one-year chart. February: There’s a rally in early February. That rally along a diagonal trend line completes with a fast sudden move to the upside, followed by a decline through that diagonal trend line with increasing volatility on the way down. We sell from a year’s high in February. We’ll likely see that high in the third week. There’s a notable fake out around a crest or high where we attempt to establish support. We’ll then decline further, and it looks like this will create another prominent low at the end of the month or in early March. March: There’s a lot of price movement the first week of March. There are multiple failed attempts to break through key resistance on a one-year chart. We’ll have some sideways rotation around the month’s high. It looks like a significant rally will commence around the month’s low. This will likely be another important low for the year. There will be some sideways rotation along support, and then there’s a fast, sudden move higher, likely in the third week. In late March, we have volatility that increases as we move forward into the end of the month. We have another prominent low, although this is in the midst of a bullish trend, so the lows will be consecutively higher as we move forward. April: In early April, we’ll decline from a crest with sideways fluctuations with a bearish trend. In mid-April, it looks like we’ll have a sharp drop into another month’s low. There’s a good swing trade opportunity around the low. The trade opportunity involves a sharp drop within a period of volatility. We’ll then have erratic back and forth through the same price level in late April, and it looks like there’s also a breakout there to the upside. Eventually we hit a key resistance level on a multi-year chart, and we break down with consecutively lower spikes up on the way down which brings us to another trough in early May. May: There’s a sharp decline from a peak or crest that will stand out on at least a one-month chart. We move into another prominent trough for the year after there’s a failed attempt to break through key resistance around the month’s high for May. Technicals will lead us to believe that we’ll break out through that price level, but we’ll turn around and decline through key support on at least a one-month chart. The decline into the month’s low offers a significant opportunity to open up a long position. In late May, there’s a notable move to the upside out of a decline. I’m advised to avoid risk and possibly open up protection around this time. We’ll possibly see a brief highest high for the year thus far around this time. This could be easily missed because off of that high there’s a decline through multiple support levels on a one-year chart. June: There’s a swing trade opportunity around the month’s high. This may be the next highest high for the year. There is a period of volatility and three pokes through the same price level around the month’s high and a sharp drop after the third poke. It looks like we’ll move into another prominent trough for the year in late June. Bullish price swings will bring us out of that trough. July: There’s a bit of decline that increases with momentum as we move into mid-month. There’s a bit of a U-shaped dip around the month’s low. There’s a swing trade opportunity around the month’s low, involving a period of sideways fluctuations with a bullish trend that precedes a decline. In late July, we’ll have a notable rally higher that will stand out on a one-year chart. This rally, which appears to move into the same highest high we had in June, offers the opportunity to open up a short position. There’s also a breakout in the midst of that rally higher in late July. There’s another swing trade opportunity at this point involving a period of volatility with a sharp dip that will stand out on a one-month chart. It looks like this rally to the upside will continue into August. August: There’s a breakout that will stand out in the midst of the rally into the high. There’s an opportunity to open up a short position around this time. The high for the month forms after a failed attempt to break through key resistance on a one-month chart. This is followed by a breakdown through key support on at least a one-month chart. There are two swing trade opportunities: one opportunity is near a crest, likely the third or fourth week of August. September: We’ll see a rally that increases with momentum moving into mid-September. There’s a swing trade opportunity involving a period of sideways fluctuations with a bullish trend that precedes a decline near the high in September. We rise to meet the nearest critical resistance, we bump off of it and then decline to continue rotating alongside support. The month’s low is in close proximity to a prominent crest for the year. In late September, there’s a key cash-in opportunity at a significant trough for the year. This will likely be around an attempt to establish a critical support level on at least a one-year chart. There’s a crest toward the end of the month after a continued decline. The year’s low may be around this time or around early October. October: In early October, we have a period of sideways rotation along key support and a sharp dip that will stand out on at least a one-month chart. That dip will take us down to a support level that was recently a past opportunity. There’s a lot of price movement to meet the month’s high in October. There’s also a cash-out opportunity at the month’s high and an opportunity to open up some protection. There’s a swing trade opportunity around the month’s high as well that involves a period of volatility with a sharp dip that will stand out on at least a one-month chart. It looks like we have a significant move and possibly a breakout to reach the month’s high for October. The high is in close proximity to a prominent trough for the year. There’s a significant decline through multiple support levels that will stand out on at least a one-month chart to reach the month’s low. Toward the end of the month, there’s a notable move higher out of the low. November: In early November, there’s a prominent move to the upside out of a prominent trough for the year. This move higher is followed by a full retracement of that move which creates a peak or crest somewhere around the first or second week of November. Out of the month’s high, it looks like we fall from a support level to another critical support level on at least a one-month chart, and then we rotate sideways along that support level. Around the month’s low (which is also a prominent low for the year), there’s sideways S-rotation, so we have a decline from a resistance to a support and a reversal with a full retracement back to resistance. Near the end of November, there’s a significant decline through multiple support levels on at least a one-month chart. There’s a false breakout near the end of November. December: In early December, we have a period of sideways rotation that is likely bullish. There is also the start of another rally and a breakout on a one-year chart. I’m advised to be cautious around the month’s high which will be another prominent high for the year. There’s a critical resistance level met here. The low for December is within close proximity to that prominent high. The low forms when we hit resistance and then we decline with increasing volatility as we move forward in time. It looks like there will be multiple false tops or some sort of trickery around the high. Near the end of the month, there’s a fast, sudden move higher. Sneak preview We push the upper end of a range higher on the scale of a multi-year chart. #0TheFool #10ofCups #XVTheDevil #PrinceofDisks #XVIIITheMoon #5ofWands #2ofSwords #5ofCups #3ofSwords #4ofWands #9ofSwords #KnightofWands #4ofDisks #8ofSwords #PrinceofSwords #IIITheEmpress #6ofCups #XVITheTower #9ofWands #8ofCups #2ofWands #7ofCups #10ofWands #QueenofSwords #KnightofDisks #XIXTheSun #XXITheUniverse #VIITheChariot #PrincessofCups #XIIIDeath #9ofCups #PrincessofWands #3ofDisks #6ofWands #ITheMagus #5ofDisks #8ofDisks #PrinceofCups #AceofWands #7ofSwords #XTheFortune #PrinceofWands #AceofDisks #QueenofDisks #10ofDisks #VITheLovers #10ofSwords #7ofWands #8ofWands #IITheUniverse #5ofSwords #XVIITheStar #QueenofWands #PrincessofDisks #3ofCups #7ofDisks #QueenofCups #AceofSwords

- AMC October 2022 Psychic Predictions

Month’s theme : We have the completion of a rally, however that behavior is nullified. Behavior around the high: A brief high followed by a notable decline. Behavior around the low: There’s a big move to the upside out of the low. The month’s low will likely be on the 12th. Trade opportunities : On the 5th, there’s a trade opportunity to open up a long position in the midst of a decline. Two trade opportunities on the 21st: One involves the completion of a bullish trend marked by a fast, sudden move higher and then a breakdown through a diagonal trend line that we were rallying along. The other swing trade opportunity involves a notable decline that will stand out on a one-day chart. This offers an opportunity to open up a long position. Overview: Week One (10/3-10/7): On October 3rd, we’ll have a decline to and through a support level. There will be a reversal below the support level where we then move back up to reuse that support. There are two local or prominent highs and one local. There’s also a trade opportunity on the 3rd involving sideways fluctuations with a bullish trend preceding a decline. On the 4th, there’s a notable decline through multiple support levels. There’s one local high and multiple failed attempts to break through key resistance around that high. On the 5th, we’ll have our first low or prominent trough for the month. There will be sideways fluctuations with a bearish trend preceding a rally. There’s a trade opportunity to open up a long position in the midst of a decline. There are two crests toward the end of the day on the 5th. On the 6th, there’s a big drop that will stand out on a one-month chart. On the 7th, we have another low. It looks like we’ll have volatility on the 7th with a sharp dip that will stand out on a one-day chart. Week Two (10/10-10/14): There’s a big move over the weekend or early in the morning on the 10th. This move is an intentional fake out or shake out. On the 11th, it looks like we’ll probably have a prominent crest on a one-month chart. A not-so-common leader is highlighted here. There may be a holding pattern of some kind followed by a big pop up and drop back down. On the 12th, we’ll likely have a notable decline and the low for the month. We’ll begin to move higher again on the 13th. There are also three prominent highs on a one-day chart on the 13th. On the 14th, we have three failed attempts to break through key resistance followed by a decline back down to revisit the month’s low. There’s a big move over the weekend where we go from a low to a notable gap up. Week Three (10/17-10/21): On the 18th, there’s a lot of volatility and a critical resistance level is highlighted. It looks like we’ll have a prominent trough early on the 19th. We’ll also have selling from overbought territory on the RSI. We’ll likely see a month’s high on the 19th or 20th. On the 20th, we’ll see the start of a rally that increases with momentum moving forward in time. There’s another prominent trough on the 21st with some highs in the midst of it. There will also be a decline to and through a support level to meet another support level, and then we rotate sideways along that support level. I’m advised to open up protection in the midst of a rally near the low at the end of the day on the 21st. We’ll also have a prominent trough on the 21st. There are two swing trade opportunities: One involves the completion of a bullish trend marked by a fast, sudden move higher and then a breakdown through a diagonal trend line that we were rallying along. The other swing trade opportunity involves a notable decline that will stand out on a one-day chart. This offers an opportunity to open up a long position. On the 25th, there are multiple false tops or some sort of tricky behavior. There are two prominent highs on a one-day chart on the 25th. On the 26th, we’ll see two prominent highs again. On the 27th, we rotate sideways along key support on a one-month chart. We’ll rise a bit to meet the closest critical resistance and then we drop back down to the last critical support level. On the 28th, that rotation turns more into bullish price swings. There’s a decline over the weekend or early on the 31st. From that decline, we’ll see a fast, sudden move to the upside marking the end of a decline. #8ofSwords #8ofCups #PrinceofWands #4ofCups #10ofSwords #IIITheEmpress #7ofDisks #QueenofSwords #XVTheDevil #VTheHierophant #AceofCups #ITheMagus #3ofSwords #5ofCups #VIITheChariot #4ofWands #PrinceofCups #2ofSwords #UnicursalHexigram #KnightofWands #PrinceofWands #0TheFool #AceofWands #5ofWands #XIITheHangedMan #AceofSwords #10ofCups #XIXTheSun #5ofDisks #XIIIDeath #8ofDisks #7ofWands #3ofDisks #2ofWands #KnightofCups #6ofSwords #VIIIAdjustment #3ofCups

- November 18, 2022 S&P 500 Predictions (RATED)

*Accuracy rating update: 93% or 13/14 predictions correct* Day’s theme : A rally that increases with momentum moving forward into the day. Behavior around the high: Sideways rotation along a support level, and there’s a fast, sudden move higher marking the end of that period of rotation. Behavior around the low: Congress should be highlighted near the low. There may also be a big move higher followed by a full retracement. Trade opportunities : N/A Overview: On November 18th, we rally to a key resistance level and then decline from that resistance level with consecutively lower spikes up on the way down in the pre-market. There looks to be a rally out of the open with a pretty fast move to the upside where we’ll see a day’s high. I’m advised to be cautious around the open. We break through resistance and then we break back down through that same price level shortly thereafter. There’s a day’s low toward the end of the morning or midday. There’s a big decline around noon after a failed attempt to break through resistance followed by a decline through support. Between roughly noon and 1:00 p.m., we move higher and push the upper end of a range higher, and then a rally that increases with momentum moving into the 2:00 p.m. hour. We come up against the upper end of a range between roughly 2:00 p.m. and 3:00 p.m. There’s a bullish trend in the last hour. Right around the close, we have multiple failed attempts to break through key resistance. There’s an important price level highlighted in the post-market where volume starts to wane. Sneak preview: On the 21st, it looks like a rally breaks down through a diagonal trend line. #PrinceofWands #3ofDisks #KnightofDisks #8ofSwords #5ofWands #8ofWands #3ofCups #6ofDisks #XXTheAeon #VIITheChariot #10ofWands #XIITheHangedMan #4ofSwords #8ofDisks #VTheHierophant #KnightofWands

- November 17, 2022 S&P 500 Predictions (RATED)

*Accuracy rating update: 94% or 16/17 predictions correct* Day’s theme : A sideways S-formation (two declines and an incline in between). Behavior around the high: A notable decline off of the high that offers an opportunity to position oneself for a rally Behavior around the low: Behavior around the low is nullified or somehow made irrelevant. Trade opportunities : N/A Overview: On November 17th, the first high for the day is somewhere between the pre-market or the first half hour of trading. There’s some volatility in the first half hour. There’s a failed attempt to break through key resistance roughly between the open and 11:00 a.m. That failed attempt turns into a decline through key support. We likely meet a significant low somewhere around 11:00 a.m., and I’m advised that this is not a good opportunity to open up a new long position. Out of that low, there’s a notable move higher that will stand out on a one-day chart. We retest the same resistance level that we failed to break through earlier in the day. We’re expected to break through this resistance level, however we fail to do so. We then turn around and decline pretty hard through key support again. The second high for the day is somewhere between noon and 2:00 p.m. From that failed attempt to break through key resistance, we decline to and through a support level, meet a second support level, and then we bounce along that support level sideways for a bit. We’ll then break down through multiple support levels. Around 2:00 p.m., we rotate sideways along a key support level. We meet a critical price level in the last hour. Right around the close, there’s a decline from a support level to meet a secondary support level, and then we rotate sideways along that support. There should be a bit of a move to the upside around the post-market or overnight. #QueenofCups #10ofSwords #AceofCups #5ofDisks #2ofWands #PrinceofSwords #5ofSwords #9ofDisks #5ofCups #7ofCups #PrinceofDisks #6ofSwords #10ofDisks #10ofWands #9ofCups #KnightofDisks

- November 16, 2022 S&P 500 Predictions (RATED)

*Accuracy rating update: 100% or 15/15 predictions correct* Day’s theme : An attempt to reestablish support. Behavior around the high: A failed attempt to break through a resistance level that we expect to break through. We then turn around and decline through key support on a one-day chart. Behavior around the low: A fast, sudden rally out of the low. Trade opportunities : There’s an opportunity to open up a long position when we meet a low midday. Overview: On November 16th, there are some bullish price swings in the pre-market and into the open. Around the open, we have a move to and through a resistance level, we stay about it briefly, and then there’s a full retracement back down through that same price level. We then have a failed attempt to break through key resistance where we then turn around and decline. It looks like there’s an opportunity here to roll a position or to open a position at a support level. We’ll see both a low and a high midday. In the midst of a decline midday, there’s an opportunity when we meet a low to open up a long position. We’ll then see a big move to the upside out of that midday low to reach for a distant resistance. This will likely happen between 1:00 p.m. and 2:00 p.m. There’s a trade opportunity at that resistance level. We then decline from resistance. There are possibly some headwinds in the last hour. We’ll see some volatility as we move into the close and a sharp drop from that period of volatility. This is followed by a bit of a push to the upside that would stand out on a one-day chart right around the close, however that rally fails. We then break down through a diagonal trend line and increase in volatility as we move forward in time. We should see another low just after the close or overnight, but most likely in the post market. Sneak preview: On the 17th, we’ll revisit a support level that we recently visited. We’ll also likely open lower. #4ofDisks #VIIIAdjustment #5ofCups #10ofDisks #XXITheUniverse #2ofCups #5ofSwords #PrincessofDisks #PrincessofCups #XILust #QueenofSwords #9ofSwords #KnightofWands #2ofWands #8ofWands #QueenofDisks

- November 15, 2022 S&P 500 Predictions (RATED)

*Accuracy update: 100% or 14/14 predictions correct* Day’s theme : The completion of a rally. Behavior around the high: A fast, sudden rally into the day’s high. Behavior around the low: A decline from a support level to meet a secondary support level, and then we rotate sideways along support for a bit. Trade opportunities : There’s a decline off of a high in the first half hour that offers an opportunity to open up a long position. Overview: On November 15th, we likely open up around the same price level that we ended at on the 14th. In the pre-market or in the first half hour, we’ll see a day’s low. After that low, we rally higher to turn resistance into support momentarily. We should see a day’s high at that price level. We’ll then decline off of that move higher, likely in the first half hour. This decline offers an opportunity to open up a long position. Midmorning, we’ll see a notable move higher on a one-day chart. We sell from a crest around midday, maybe a bit earlier. We move down to and through a support level, and then we turn into a U-shaped reversal back up to reuse the previous support level. There’s quite a bit of price action midday. It looks like we’ll go from a crest into a trough, and then there’s a rally out of that trough starting around 1:00 p.m. and moving into the end of the day. Between 2:00 p.m. and 3:00 p.m., we still have bullish price movement but more so in the form of price swings. We have a high at the end of the day with a big move higher to reach a prominent resistance level right at the close. This move higher is followed by a reversal, which marks an opportunity to position oneself for a move lower. Sneak preview: On the 16th, we open up higher, likely notably higher. #IVTheEmperor #VIIIAdjustment #8ofWands #AceofSwords #QueenofDisks #PrincessofCups #10ofDisks #4ofCups #0TheFool #PrincessofWands #2ofWands #XTheFortune #AceofWands #6ofDisks #5ofDisks #6ofWands

- November 3, 2022 S&P 500 Predictions (RATED)

*Accuracy rating update: 100% or 13/13 predictions correct* Day’s theme : The halting of a rally marked by a sharp decline through a critical support level on a multi-day chart. Behavior around the high : I’m advised to be cautious around the high. There may be some sort of fake out or shakeout. Behavior around the low : We have a cash-out opportunity around the low. The day’s low will likely be right around the open. Trade opportunities : Sell puts around the open. Overview: On November 3rd, we’ll have a low right around the open and there’s an opportunity to sell puts around this time. This will be followed by a move to the upside that turns resistance into new support. We then break back down through key resistance during selling from overbought territory on the RSI. Between roughly 10:00 a.m. and 11:00 a.m., we have some erratic behavior back and forth through the same price level. We then revisit a crest that was recently a past opportunity. Between roughly 11:00 a.m. and noon, there’s a big move higher followed by a full retracement of that move back down to where the rally started. Between noon and 1:00 p.m., there’s a period of volatility with a sharp dip in the midst of that volatility that stands out on a one-day chart. We’ll then decline through multiple support levels due to multiple headwinds. Around the early afternoon, there’s a sharp decline through multiple support levels on a one-day chart. Around 2:00 p.m., there will be a bit of a peak, however it’s in the midst of a decline that moves into the end of the day. There’s a sharp drop around the close, but there’s a fast, sudden move higher out of that drop marking a breakout in the post-market. Sneak peek: We open up much higher on November 4th. #XIITheHangedMan #XVTheDevil #8ofDisks #KnightofCups #PrinceofCups #10ofCups #6ofCups #XIVArt #QueenofSwords #10ofSwords #9ofSwords #10ofWands #6ofWands #6ofDisks #PrincessofDisks #XILust

- October 31, 2022 S&P 500 Predictions (RATED)

*Accuracy rating update: 100% or 14/14 predictions correct* Day’s theme : A failed attempt at a breakout or a brief breakout that doesn’t last. Behavior around the high : An unexpected failed attempt to break through key resistance around the high. We then turn around and decline through key support on a one-day chart. Behavior around the low : An unexpected move to the upside out of the low. Trade opportunities : I’m advised to trade around a prominent trough on a one-day chart. There’s a trade opportunity at a new support level between 10:00 a.m. and 11:00 a.m. I’m advised to cash in at the end of the day. Overview: On October 31st, we have a notable move to the upside out of oversold territory in the morning. There’s also a day’s low early in the morning. We have a notable move to the upside out of that day’s low and some volatility. There may be some news that comes out around that low. Between roughly 10:00 a.m. and 11:00 a.m., we have a move to the upside into a day’s high that successfully turns resistance into new support. There’s a trade opportunity around that support level, however we don’t stay at that high very long. We decline from that new support level between roughly 11:00 a.m. and noon after being near overbought territory on the RSI. Between noon and 1:00 p.m., there are sideways price swings with a bullish trend. I’m advised to open up some protection in the midst of a crest around this time. A decline commences after three criss-crosses back and forth through the same price level somewhere between noon and 2:00 p.m. The third cross will confirm a bullish trend but it appears to be a fakeout. There’s a move to the upside followed by a full retracement back down. We have a notable drop toward the end of the day and a lot of price movement around the close. There’s a move higher through resistance followed by a breakdown through that same price level shortly thereafter. This will be in the midst of some sideways price swings with a bullish trend. Sneak preview: A notable decline due to multiple headwinds on November 1st. #6ofWands #XIIIDeath #5ofCups #VIITheChariot #VIIIAdjustment #PrinceofSwords #6ofDisks #9ofCups #2ofWands #3ofWands #XIVArt #PrincessofDisks #IVTheEmperor #7ofSwords #XVIITheStar #9ofSwords

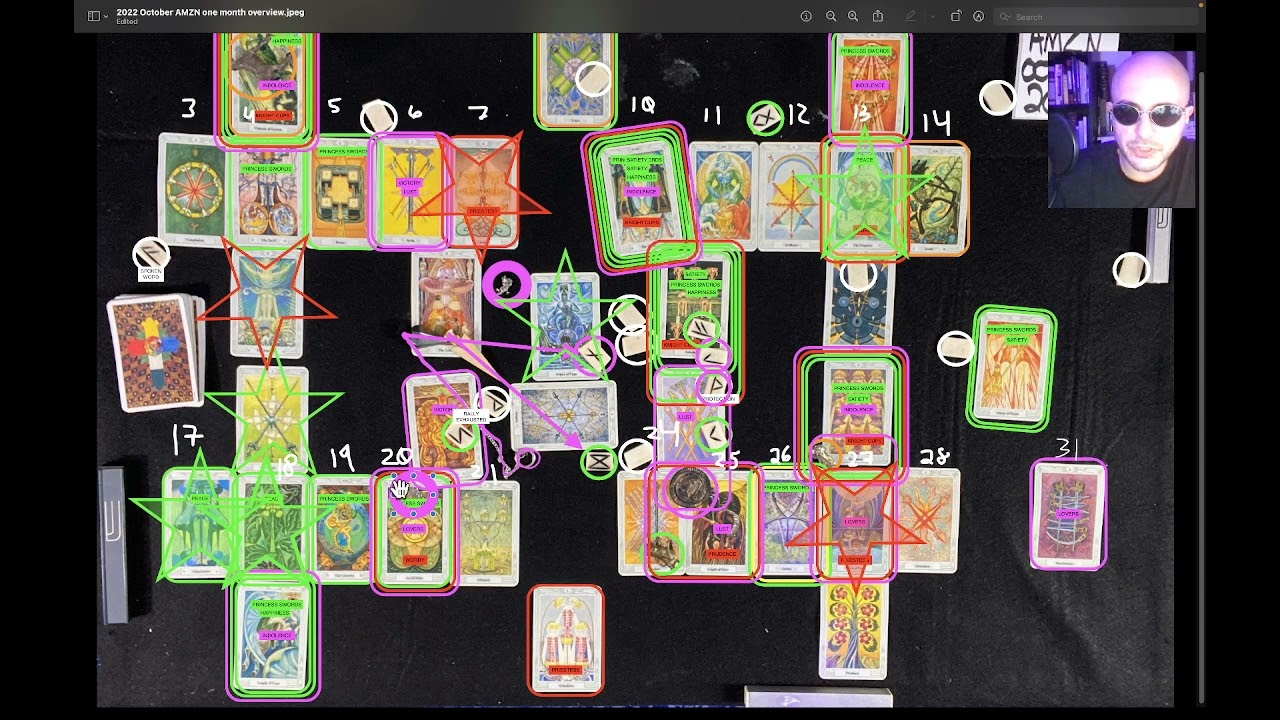

- Amazon ($AMZN) October 2022 Predictions

Month’s theme : A decline off of a significant high on a multi-day chart. Behavior around the high: A critical price level is highlighted at the high. There will also be a lull in volatility and volume around the high. Behavior around the low: Around the low, we have a move higher through a resistance level. We stay above that price level briefly and then break back down. The low is likely within close proximity to a minor crest. Trade opportunities : Two opportunities on the 6th. One involves a breakout on a one-day chart, and the other involves a big move to the upside on a one-day chart that reaches for a distant resistance level. There’s a swing trade opportunity on the 10th. Around the 25th, there’s a swing trade opportunity involving a big move to the upside. On the 27th, there’s a swing trade opportunity involving an agreement between two leaders. On the 31st, there’s a swing trade opportunity in the midst of multiple failed attempts to break through key resistance. Overview: Week One (10/3-10/7): On October 3rd, we likely have the completion of a bullish trend. There appears to be a notable amount of price movement on the 4th and possibly on the 5th. There’s also an intentional fake out or false triggering of an indicator on the 4th. On the 5th, we attempt to establish support, and there’s a crest toward the end of the day. On the 6th, we have a decline through a resistance level, and as we fall we have consecutively lower spikes up on the way down. There are two trade opportunities on the 6th, possibly a day trade opportunity. One involves a breakout on a one-day chart, and the other involves a big move to the upside on a one-day chart that reaches for a distant resistance level. On the 7th, we’ll likely have a first low for the month. Week Two (10/10-10/14): On the 10th, we’ll have three local highs, one local low, and a swing trade opportunity. We’ll have a brief high before a notable decline. On the 11th, there’s a prominent move higher that will stand out on a multi-day chart, followed by a full retracement of that move back down. On the 12th, we’ll have a higher high than we did on the 11th. There’s a fast, sudden move to the upside on the 13th. We’ll also see a rally into a month’s high on the 13th after bearish price swings. There will be a lull in volume around that high. We then decline out of the high, increasing with momentum as we move forward. There’s a prominent trough that forms on the 14th. Week Three (10/17-10/21) On the 17th, we have a move higher out of oversold territory. We’ll reach a month’s high around that move to the upside. On the 18th, there will likely be a month’s crest. We’ll see three pokes through the same price level followed by a sharp decline. On the 19th, there’s a sharp decline. The high on the 19th offers an opportunity to position oneself in both directions. On the 20th, we have an important support level that forms after a sharp decline. I’m advised to open up protection midday. On the 21st, we’ll see a decline to and through a support level. We move sideways along that support level and then decline further. It looks like we have a pretty sharp decline over the weekend. Week Four (10/24-10/31) On the 24th, we’re bound by a range on a multi-day chart. There’s a rally that starts mid-afternoon. On the 25th, there’s a cash out opportunity at the end of the day or early in the morning. There’s also a swing trade opportunity on the 25th involving a big move to the upside. We’ll then see some sideways rotation along a key support level on a multi-day chart followed by a fast, sudden move to the upside that marks the end of that period of sideways rotation. On the 26th, there’s a failed attempt to break through key resistance and an opportunity to position oneself in both directions. There’s also a significant technical price level for the month that’s highlighted around this time. We’ll then see a decline through key resistance followed by a decline through key support. There will likely be another month’s low on the 27th. There’s a trade opportunity on the 27th involving an agreement between two leaders. On the 28th, we have bullish price swings. On the 31st, there’s another swing trade opportunity in the midst of multiple failed attempts to break through key resistance. Sneak preview: In November, we’ll see a rally along a diagonal trend line that breaks through horizontal resistance, meets a secondary resistance, and then dips back to somewhere between those two price levels. We’ll likely decline into November before we turn back around. #PrincessofSwords #4ofSwords #10ofCups #4ofWands #XVTheDevil #4ofDisks #5ofWands #4ofCups #XVIIITheMoon #XIVArt #8ofWands #IIITheEmpress #XIIIDeath #IITheUniverse #VITheLovers #PrinceofCups #8ofCups #5ofDisks #QueenofWands #2ofSwords #XILust #6ofSwords #6ofWands #9ofCups #VIIIAdjustment #3ofSwords #XXITheUniverse #AceofDisks #7ofCups #10ofWands #KnightofDisks #5ofSwords #QueenofCups #2ofWands #8ofSwords #KnightofCups #3ofCups #8ofDisks

- SHIB Coin September 2022 Predictions

Month’s theme : Sideways rotation along a key support level that ends with a fast, sudden move to the upside. We’ll also see a lot of sideways movement throughout the month. Behavior around the high: A failed attempt to break through a key resistance level, followed by a decline through a key support level on a one-month chart. Behavior around the low: A higher level and a lower level around the low in the near future. Trade opportunities : There’s a swing trade opportunity on the 1st involving an opportunity to open up a long position in the midst of a decline. Around the 2nd, there’s a trade opportunity that involves a sudden move higher marking the end of a period of volatility. Around the 3rd, there’s a swing trade opportunity around a notable drop. Around the 4th, there’s a trade opportunity around where we begin to sell off. Around the 5th, there’s some deception around a low and a swing trade opportunity involving a fast, sudden move higher marking the end of a period of volatility. There are two trade opportunities around the 9th: one involves a decline that marks an opportunity to open up a long position. The other involves a fast, sudden move higher marking the end of a period of volatility. There’s another swing trade opportunity around the 10th that involves a fast, sudden move higher marking the end of a period of volatility. Around the 12th, there’s a trade opportunity involving a decline that offers an opportunity to open up a long position. Around the 18th, there’s a swing trade opportunity in the midst of multiple failed attempts to break through key resistance. Around the 19th, there’s a swing trade opportunity in the midst of volatility that ends with a fast, sudden move to the upside. Around the 20th, there’s a swing trade opportunity in the midst of a decline that offers an opportunity to open up a long position. Around the 21st, there’s an opportunity to open up a long position in the midst of a low. Around the 28th, there’s an opportunity to open up a long position in the midst of a decline. Overview: Week One (09/1-09/8) Around September 1st, we have three pokes through the same price level followed by a sharp decline after that third poke. Around the 2nd, it looks like there may be a bit of a move higher followed by a full retracement back down to where the move higher started. We’ll see a prominent high on September 3rd. We’ll also hit an important resistance level and have an unexpected move upward on the 3rd. On the 4th, that previous unexpected move upward is followed by a decline from overbought territory. There’s a decline down to a month’s first low on the 4th as well. There are swing trade opportunities from the 1st through the 5th (see trade opportunities at the top). On the 6th, we have a rally that increases with momentum moving into the end of the day. We reach a key resistance level around the 7th and fall pretty sharply into a minor trough for the month. On the 8th, we open up a bit higher, however we’ll see another low for the month after we hit resistance again and continue to decline. Week Two (09/9-09/16) On September 9th, we’ll see two local highs, meaning two highs or crests that stand out on a one-day chart. One high involves sideways rotation along a support level with increasing bullish sentiment and momentum as we move forward in time. The other high will be around a sudden dip within a period of volatility. There are two trade opportunities around the 9th: one involves a decline that marks an opportunity to open up a long position. The other involves a fast, sudden move higher marking the end of a period of volatility. There’s another swing trade opportunity around the 10th that involves a fast, sudden move higher marking the end of a period of volatility. There will also be a decline through multiple support levels on the 10th. On the 11th, we have a key support level highlighted, and we may be attempting to establish a new support level in the midst of a rally higher. On the 12th, we revisit a support level when we have a sudden dip within a period of sideways rotation. There’s also a swing trade opportunity on the 12th involving a decline that offers an opportunity to open up a long position. There’s a key resistance level highlighted on the 12th and the 13th. Somewhere around the 12th or 13th, there’s a bit of a move to the upside. That move to the upside is halted when we have a decline through a key critical support level to meet another month’s low on the 13th. Out of the low on the 13th, there will be a rally along a diagonal trend line breaking through horizontal resistance to meet a secondary resistance level. We’ll then dip back to somewhere between those two price levels. On the 14th, there’s a rally into a notable move higher that will stand out on a one-month chart. We also have a key support level highlighted as well as a local high and a local low. On the 15th, we have another prominent trough for the month. We decline through multiple support levels after meeting a resistance level. On the 16th, we have a critical technical price level and possibly a notable crest. Week Three (09/17-09/24) On the 17th, we have a move higher through resistance level followed by a decline back down through that same price level shortly thereafter. Around the 18th, there’s a swing trade opportunity in the midst of multiple failed attempts to break through key resistance. There’s also a bit of volatility on the 18th that ends with a fast, sudden move to the upside. Around the 19th, there’s another swing trade opportunity in the midst of volatility that ends with a fast, sudden move to the upside. On the 20th, there’s a fast, sudden move higher. One local low will form when out of a decline we have a move from the bottom of a range to the top of a range. There’s also a swing trade opportunity in the midst of a decline on the 20th that offers an opportunity to open up a long position. We’ll see a month’s low around the 20th or 21st. There’s also another month’s low on the 21st and an opportunity here to open up a long position for the coming high we should see in early October. On the 22nd, we have two local lows and one local high in the midst of a prominent decline on a one-day chart. One local low will form when out of a decline we have a move from the bottom of a range to the top of a range. The other local low will involve some erratic behavior back and forth through the same price level. The local high will involve a sudden dip out of the high which will form within a period of volatility. It looks like we have a failed attempt to establish support on the 23rd. There’s some trickiness on the 23rd, possibly an intentional fake out of some sort. On the 24th, we have a U-shaped dip. From that price level, we attempt to establish support. We move down to a low and around that low there’s a move higher through a resistance level on a one-day chart, and then we break back down through that price level shortly thereafter. Week Four (09/25-09/30) On the 25th, we have three local highs. It looks as though there will be a pretty prominent crest that forms here. One local high forms in the midst of some sideways bullish price swings. Another high forms when we have three criss-crosses back and forth through the same price level, confirming a bullish trend. The third local high forms when we have a period of volatility that ends with a sudden dip. I’m advised to open up some protection in the midst of a rally on the 25th. On the 26th, we hit a key resistance level. There are sideways fluctuations along support throughout the day with equal amounts of bulls and bears. There’s also a prominent trough for the month that stands out on the 26th. There’s likely a prominent trough around the 27th. On the 27th, out of a decline there’s a fast, sudden move higher that marks the end of that period of decline, and from there we meet key resistance again. On the 28th, we have a prominent move higher that is matched by a full retracement back down to where the move higher started. There’s also an opportunity to open up a long position in the midst of a decline. On the 29th, there’s one local low that involves a move higher through resistance on a one-day chart and then breaking back down through that same price level shortly thereafter. There’s another prominent trough for the month on the 30th after we hit a resistance level. There’s an attempt to establish support on the 30th as well. Sneak preview: For October, an important price level is highlighted, likely near the crest on September 16th. #2ofWands #5ofSwords #PrinceofDisks #3ofSwords #VTheHierophant #XVIITheStar #10ofCups #VITheLovers #PrinceofWands #XXITheUniverse #XVIIITheMoon #IIITheEmpress #7ofDisks #XIXTheSun #QueenofDisks #XIITheHangedMan #AceofWands #8ofCups #3ofCups #PrincessofCups #KnightofDisks #0TheFool #6ofCups #2ofSwords #QueenofSwords #KnightofSwords #AceofSwords #9ofCups #UnicursalHexigram #3ofWands #4ofSwords #2ofCups #8ofSwords #9ofSwords #8ofWands #PrinceofCups #AceofCups #8ofDisks #IITheUniverse #4ofWands #2ofDisks #KnightofCups #XIVArt #VIITheChariot #4ofDisks #QueenofWands #PrincessofSwords #9ofWands

- October 27, 2022 S&P 500 Predictions (RATED)

*Accuracy rating update: 92% or 11/12 predictions correct* Day’s theme : An attempt to establish new support at a high. Trade opportunities : There's an opportunity to buy calls around the open and sell them between 2:00 p.m. and 3:00 p.m. Overview : On October 27, 2022, we have sideways rotation with a bullish trend that precedes a decline in the pre-market. Right around the open, there’s a decline that offers an opportunity to buy calls, however this opportunity is brief. Even in the face of seemingly overwhelming headwinds, that decline is followed by a move to the upside around 9:45 a.m. There’s an opportunity to open up a long position as a rally commences between 10:00 a.m. and 11:00 a.m. This rally continues between 11:00 a.m. and noon. The rally is cut short by being range bound around midday and then we have a bit of a decline from roughly 1:00 p.m. to 2:00 p.m. We’ll then see a prominent trough around 2:00 p.m. Out of that trough, there’s an unexpected and prominent move to the upside. There’s a cash out opportunity to sell the calls purchased earlier in the day between 2:00 p.m. and 3:00 p.m. We’ll see a completion of a rally around 3:00 p.m. and a lot of movement toward the close. There’s a big price movement in the last hour of trading. In the post-market, we’ll see a U-shaped dip. Sneak preview : A good trade on the 28th in the midst of sideways S-shaped rotation between horizontal resistance and support. #4ofDisks #ITheMagus #2ofDisks #4ofCups #VIITheChariot #PrincessofCups #XIXTheSun #10ofDisks #10ofWands #XIIIDeath #PrincessofDisks #4ofWands #IITheUniverse #7ofSwords #4ofSwords #QueenofCups